Measuring Success: A Guide to Effective Campaign Measurement

You’ve done it! After months of planning, strategizing and collaborating, your marketing campaign is finally ready to launch. The creative is ready, the media plan is set, and the excitement is palpable across the team. You’ve navigated through agency discussions, creative iterations and even consumer research to get here — and your executive team is on board. But before you pop the champagne, there’s one crucial question: Have you thought about how you’ll measure success?

A solid measurement plan is just as important as the campaign itself.

How will you demonstrate results to leadership?

More importantly, how will you pivot mid-campaign if things aren’t going as planned?

In this guide, we’ll explore the essential steps to developing an effective measurement plan that ensures your campaign delivers from launch to final report. A strong measurement framework helps you track performance in real-time, optimize strategies as needed, and ultimately prove the value of your marketing efforts.

Understanding Campaign Effectiveness Metrics | Setting KPIs & Goals with Marketing Performance Metrics | Approaching Measuring Consumer Response | Using Commercial Metrics to Measure ROI | Key Takeaways

Understanding Campaign Effectiveness Metrics

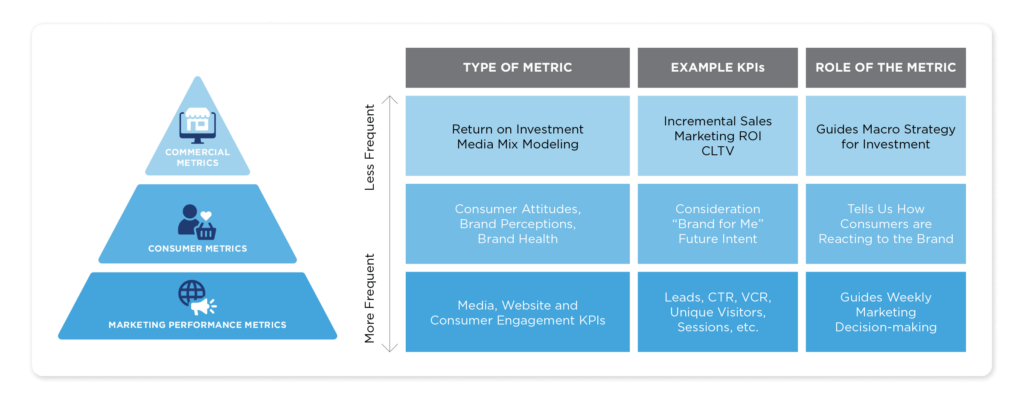

Let’s begin by better understanding three core types of campaign effectiveness metrics.

1. Marketing Performance Metrics: The Foundation

Marketing Performance Metrics are the bedrock of our measurement pyramid. These are the day-to-day indicators that give you real-time insight into how your campaign is performing.

Are your ads being seen?

Are your ads driving clicks, site visits and engagement?

Metrics like impressions, click-through rates (CTR), website visits and video completion rates (VCR) will be your first line of feedback. Delivered through dynamic dashboards, these metrics provide instant, actionable data to optimize media spend across platforms.

2. Consumer Metrics: Measuring Creative Impact

The next level of our pyramid focuses on Consumer Metrics. These are designed to answer questions like:

Is your creative breaking through with your audience?

Is your message resonating with consumers?

Is your message improving your brand perceptions or driving greater purchase consideration?

To measure these outcomes, we typically turn to primary research methods — surveys, interviews and focus groups — that capture how your campaign is influencing brand measures like awareness, perception and purchase intent.

Consumer metrics are generally going to be delivered less frequently than marketing performance metrics given the time and complexity of data collection involved.

3. Commercial Metrics: Proving Business Value

At the top of the pyramid are the Commercial Metrics. This is where you’ll assess the ultimate question: Was your campaign a good investment?

To do this, you will need to understand the concepts of incrementality — how much of your sales increase can be attributed to the campaign — and Marketing Return on Investment (MROI).

Isolating incremental sales due to your marketing campaign can be statistically challenging, which is why we lean on our Data Science team for this all-important task. Later on, we’ll walk you through the fundamental approaches to measuring incrementality and calculating MROI, without getting too bogged down in technical details.

In today’s fast-paced, results-driven landscape, building an effective measurement plan is key to understanding the true value of your marketing campaign and unlocking its full potential. This requires continuously tracking, optimizing and proving your impact every step of the way.

By integrating marketing performance metrics, consumer metrics and commercial metrics, you gain a comprehensive view of your campaign’s effectiveness and the agility to make data-driven adjustments in real time. With the right measurement strategy, you can optimize performance, maximize impact and drive measurable success at every stage of your campaign.

Setting KPIs & Goals with Marketing Performance Metrics

We outlined a comprehensive framework for successful campaign measurement planning, highlighting the importance of three types of metrics: Marketing Performance Metrics, Consumer Metrics and Commercial Metrics.

Now, we’re focusing on Marketing Performance Metrics — critical components that lay the groundwork for effective campaign measurement. These metrics deliver real-time insights, empowering marketers to make informed adjustments and optimize campaigns as needed. For media planners, they are invaluable for reallocating budgets across platforms to maximize impact. Meanwhile, strategists and clients benefit from enhanced transparency, allowing them to clearly assess campaign performance against established goals.

Why Is a Marketing Performance Metrics Plan So Important?

Before we dive into the how, let’s address the why.

Why do you need a well-constructed marketing performance measurement plan?

I like to summarize the key benefits with the acronym AAA — no, this isn’t about the roadside assistance company that helps you when your car breaks down! AAA stands for: Accessibility, Accountability and Actionability. These are three features of a marketing performance metrics plan that can empower your team to act effectively and efficiently:

1. Accessibility

Marketing metrics need to be easily accessible to everyone involved in the campaign. Media planners and buyers, strategists, and clients should have clear visibility into how the campaign is performing. We live in the age of data democratization, where metrics and performance data are readily available through sophisticated yet slick dashboards and marketing intelligence platforms. When everyone — from media buyers to clients—has easy access to this data, it sets all involved parties up for success.

2. Accountability

Accessibility breeds accountability. With clear visibility into the data, media buyers can ensure that media platform partners are delivering the promised results. At the same time, strategists and clients can confirm that the campaign is on track. Everyone is essentially “looking over each other’s shoulders” to make sure expectations are being met.

3. Actionability

With easy access and a culture of accountability in place, you gain actionability. Real-time insights allow media buyers and strategists to make informed decisions quickly. When everyone is aligned, and the data is presented in an easy-to-understand format, the team can efficiently pivot or adjust tactics to optimize the campaign.

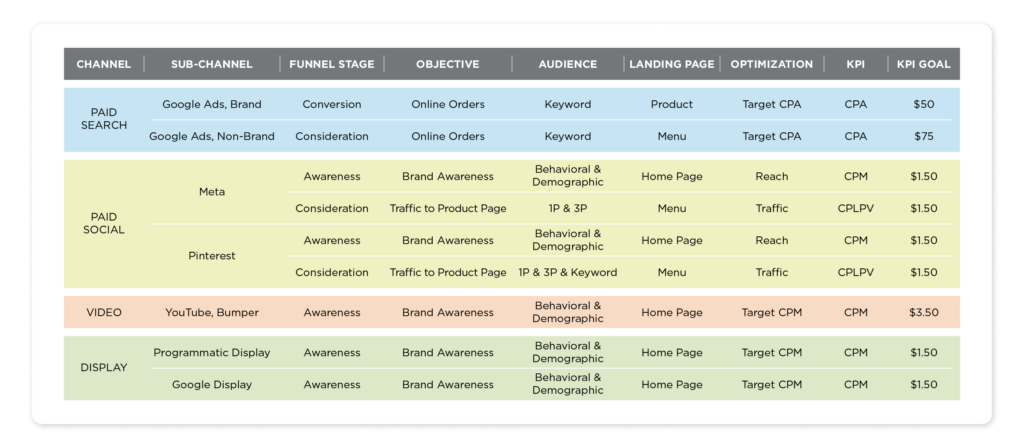

Designing a Marketing Performance Measurement Plan

Now that we understand the why, let’s move on to the how. Below, you’ll find a visual representation of a sample measurement plan that illustrates the core components. As you see, the process hinges on having clearly defined objectives by media channel, so that is where we will begin.

Match Business Objectives with Your Funnel Stage

To create an effective marketing campaign, it’s essential that every channel you select aligns with both the customer journey and your overarching business objectives.

Which stage of the funnel are you aiming to influence?

Are you focused on generating awareness, driving consideration or driving conversions?

For instance, television advertising is particularly effective for building brand awareness at the top of the funnel, while paid social media can serve multiple purposes — both enhancing awareness and facilitating conversions based on your specific goals and approach.

For example, if platforms like Meta (Facebook/Instagram) are part of your strategy, they can cater to both awareness and consideration stages. At the awareness phase, your goal might be to enhance brand recall, while in the consideration phase, you may focus on increasing traffic to your website. Clearly defining these objectives at the outset ensures alignment with all teams — creative and media — as you progress.

Define Your KPIs for Success

Once your channels and objectives are set, it’s time to define the metrics that will tell you how well your campaigns are working. These are your Key Performance Indicators (KPIs) — the critical signals that indicate whether you’re on the right track.

You’ve likely heard of the S.M.A.R.T. framework — Specific, Measurable, Attainable, Relevant and Time-bound — often used to create clear and actionable goals. This is a time-tested approach for setting actionable goals whether for business growth, personal development or, in this case, marketing performance.

For example, consider the goal of “increasing traffic.” While it sounds good on paper, it’s too vague. What type of traffic are we measuring — website visits, foot traffic or something else?

Without clear details, the goal becomes difficult to assess, making it hard to determine if it’s realistic or relevant. Additionally, we would have no clear timeframe over which to track progress.

Now, let’s look at a more well-articulated goal: “increase paid search sales conversion rate by 15% in Q1.” This goal is more focused, with a clear objective (paid search sales conversion), measurable target (15% increase), and a set timeframe (Q1). It’s actionable and realistic, which makes it an effective KPI.

Make Your Goals Dynamic

It is important to not take a “set it and forget approach” when developing a marketing performance measurement plan. You should start by using any available historical data and industry benchmarks to set realistic targets. But don’t stop there. Your goals should evolve. As you gather new insights and data, be ready to adjust your benchmarks. A dynamic approach allows you to stay agile and continuously improve.

Why This Matters

A strong marketing performance measurement plan goes beyond tracking numbers — it provides a structured approach to driving real impact. By aligning media channels with business objectives, defining clear KPIs and setting adaptable goals, you create a roadmap for optimizing campaigns and making informed decisions. A well-executed plan enables you to adjust strategies in real time, improve performance continuously and ensure every marketing dollar is used effectively.

Next, we’ll explore how consumer metrics help measure audience response and assess the true impact of your campaign.

Approaches for Measuring Consumer Response

Understanding how consumers respond to your campaign is just as important as tracking performance metrics. While click-through rates and video completion rates provide insight into engagement, they don’t fully explain why consumers feel the way they do about your brand or messaging. Are you building familiarity, driving consideration or reinforcing the right brand associations?

To answer these questions, you need direct consumer insights. Primary market research — particularly through quantitative surveys — helps uncover how your campaign is shaping perceptions and influencing behavior. Below, we’ll explore four of the most effective approaches for measuring consumer response.

Pre-Post Campaign Brand Lift Survey

We start our discussion on consumer response measurement with an old standby: pre-post campaign lift surveys. The strength of this approach lies in its simplicity: you measure key metrics before the campaign launches, run your campaign and then survey consumers afterward to assess the impact.

However, while the concept is straightforward, effective execution requires careful planning as you’ll need to consider things like timing, sample sizes and geographic targeting.

As a recent example, we worked with a major quick-service restaurant (QSR) that had launched a new line of meatless menu items and aimed to boost awareness beyond in-store promotion through media channels. The campaign was rolled out across five markets, using a mix of online, social and connected TV (CTV) ads. In one of the markets, we also included additional traditional media — out-of-home (OOH) and radio ads — as part of a “heavy up” strategy, with a larger media investment compared to the others, which followed the standard media plan (we’ll refer to these as the “base plan” markets).

The results were telling: the base plan markets saw a strong directional increase in awareness of the new menu items, but the heavy-up market experienced a significantly larger, statistically meaningful boost in awareness. Furthermore, the heavy-up market showed notable improvements in health perceptions compared to the base plan markets. As a result, the client chose to expand the campaign by adding OOH and radio to the media mix in additional markets to maximize awareness and build on these successful outcomes. This outcome would have been difficult to measure with marketing performance metrics alone given the common data gaps associated with more traditional media channels.

Marketing Effectiveness Surveys (MES)

Let’s dive into another valuable tool for measuring consumer response: the Marketing Effectiveness Survey (MES). Similar to a pre-post study, MESs are quantitative surveys, however, they are typically fielded in only one wave as opposed to multiple.

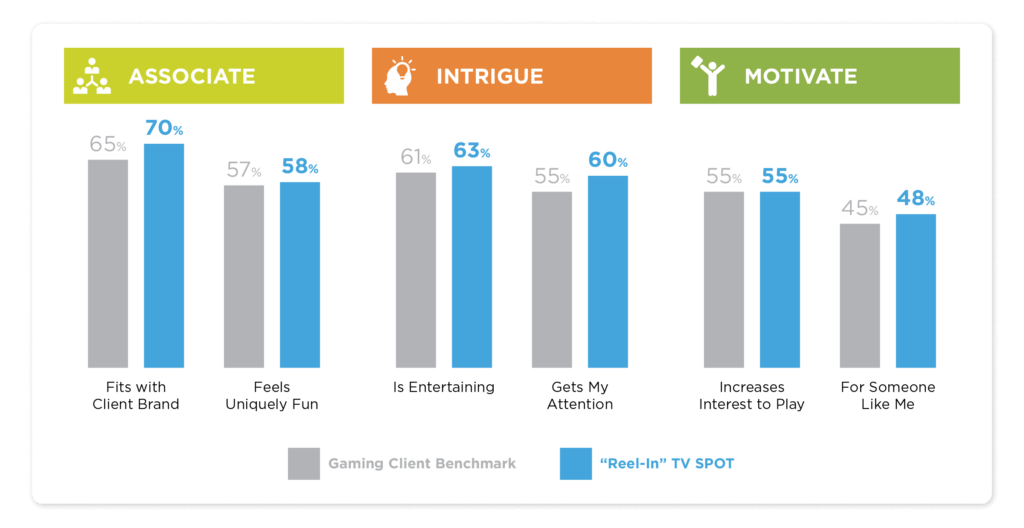

An MES is often conducted prior to launching the creative — you may hear this called Pre-Market or Copy Testing — but may also be fielded while the creative is in-market. The primary goal is to measure the creative’s ability to break through and resonate with the target audience. As such, the survey tends to focus more on the effectiveness of the creative execution — how well it captures attention, communicates the intended message and drives engagement — while spending less time on broader brand measures.

This makes MESs particularly valuable for campaigns with regular creative refreshes, allowing you to benchmark performance against past work.

For instance, we’ve worked with a gaming client for over a decade, conducting marketing effectiveness surveys to evaluate new creative. With more than 100 creative pieces tested over the years, we’ve used our AIM metrics — Associate, Intrigue, Motivate — to gauge effectiveness. The figure below illustrates how the latest ad titled “Reel-In” performed across these AIM measures. As shown, the ad received strong ratings, scoring at parity or better vs. the client norm, leading the client to decide to run it again. Being able to run the spot again provides a boost to the client’s marketing ROI — producing a new spot costs more than $500K so in this case that money could be put towards more working media.

Brand Health Tracking Studies

Next, let’s turn our attention to Brand Health Tracking Studies (BTS) — a powerful tool that extends beyond measuring the impact of individual campaigns. In fact, we view BTSs not just as a means of brand measurement but as a key brand strategy tool

These studies can be conducted at varying frequencies, from annually to continuous tracking, depending on the category dynamics and available budget.

When conducted more frequently, BTSs provides valuable insights into how your brand is responding to new campaigns over time.

However, one important caveat is that while a BTS reveals the brand’s overall health and potential campaign impact, it doesn’t provide detailed insights into the performance of the creative itself.

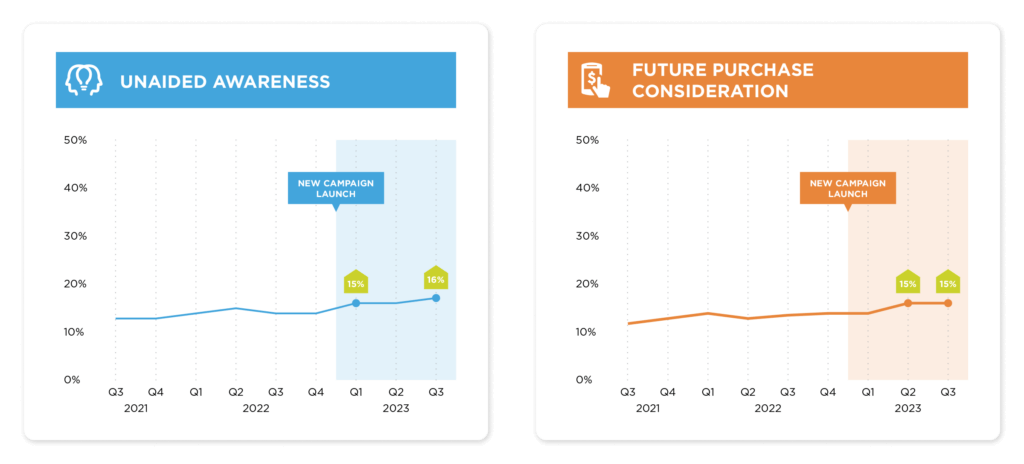

To illustrate the use of BTSs for measuring campaign impact, let’s look at an example from a leading tire manufacturer. This client launched a new campaign, introducing fresh creative and messaging, along with an incremental increase in media spend.

As shown in the figures below, we saw increases in both unaided brand awareness and purchase consideration after the campaign launch. While these shifts may seem small, they represent statistically significant changes, signaling a strong campaign effect. In addition, we know from our research across categories that gains in unaided awareness correlate with gains in consideration which, in turn, has a lagged effect on future purchase conversion.

Digital Brand Lift Studies

Finally, let’s explore Digital Brand Lift Studies, a more recent addition to the toolkit for measuring advertising effectiveness. These are online surveys designed to evaluate the impact of digital ads by comparing the responses of two groups:

- A treatment group of consumers known to have been exposed to the ad (identified through pixel tagging)

- A control group who have not been exposed, but are matched based on key demographic factors to resemble the treatment group.

One of the key advantages of Digital Brand Lift Studies is that they leverage principles of experimental design to isolate the impact of the ad on the exposed audience. This allows for a clear measurement of brand lift in areas like awareness, consideration or purchase intent. However, there are some trade-offs. The sample sizes for these studies are often limited, which can reduce their statistical power, making it harder to draw definitive conclusions. Additionally, because the surveys tend to be very short, they may lack the diagnostic depth of other methods.

Let’s take a look at an example to better illustrate both the strength and the limitations of this approach.

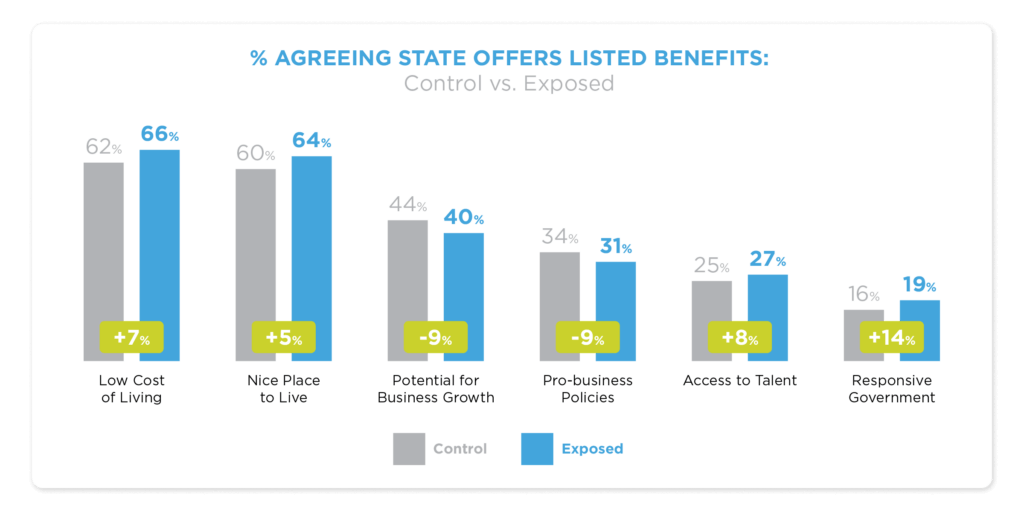

We worked with a state-run organization tasked with promoting economic growth in a specific region.

The campaign’s objective was to attract business investment by messaging against the top reasons that make the area attractive to businesses.

We saw a positive directional lift in some areas the campaign messaged against: quality-of-life, access to talent and government responsiveness.

However, when we looked at other areas the campaign messaged against, such as promoting the region as a pro-business growth environment, we saw softer metrics among treatment group, which suggests the results might be driven by statistical noise rather than true campaign effects.

Why This Matters

Measuring consumer response is a critical component of any campaign measurement plan, providing insight beyond clicks and views. It helps assess how well your marketing breaks through, resonates with audiences and influences customer behavior. Whether through pre-post campaign studies, marketing effectiveness surveys, brand tracking or digital brand lift studies, each method offers valuable insights for validating and refining your strategy.

Next, we’ll explore how to measure the true business impact of your media investments using commercial metrics.

Using Commercial Metrics to Measure the Return on Your Media Investment

Understanding the true impact of your media investment is essential for evaluating campaign success. While performance metrics track engagement and consumer response metrics measure brand perception, commercial metrics answer the fundamental question: Is your marketing driving real business results?

Commercial metrics focus on incremental sales revenue directly attributed to media efforts. They provide a clear view of how marketing influences overall business performance and help shape long-term media strategy. Below, we’ll explore three of the most effective methods for measuring commercial impact: Incrementality Testing, In-Market Testing and Media Mix Modeling (MMM).

Incrementality Testing

When it comes to deriving commercial metrics, Incrementality Testing can be seen as a “lighter touch” or more “exploratory” approach. It’s less rigorous than some of the other methods we’ll cover, but that doesn’t mean it lacks value. In fact, it can provide quick, actionable insights that help assess marketing impact and shape media strategy.

How does Incrementality Testing work?

In its simplest form, Incrementality Testing helps determine whether a specific marketing action (such as a media channel) is driving incremental sales that wouldn’t have occurred otherwise. To do this, we are essentially looking at the correlation between our media execution and sales or some other KPI of interest.

Do the two time series closely track with one another?

When we changed our media approach, did we see a corresponding signal of a change in sales?

These are the types of questions we are looking to answer.

A retail client recently wanted to expand beyond paid search marketing into a select set of awareness channels — but wanted the awareness media to run across all their geographies. We measured their commercial KPIs using incrementality testing, controlling for seasonality and trending, to see a positive movement in their KPIs when the awareness campaign kicked in.

Why do Incrementality Testing?

The main appeal of Incrementality Testing is that it is both fast and cost-effective, making it an ideal choice when you need insights quickly like, for example, when preparing for an important meeting with stakeholders. It’s also a great method for generating initial insights before committing to more complex, data-heavy approaches. And, with good data, you can even control for trending and seasonal patterns in your KPIs.

Like any method, Incrementality Testing does have drawbacks. For example, the data may not always be sufficient or reliable, and the results can sometimes be inconclusive. This is particularly true if you are working with a small sample size or if the environment has too many uncontrolled variables that need to be accounted for.

In-Market Testing

Now, let’s turn to In-Market Testing — an approach that is often underused but can provide incredibly valuable insights when done correctly. In-market testing is rooted in the principles of experimental design, allowing you to assess the true impact of a media channel or campaign in a real-world setting.

How does In-Market Testing work?

The idea behind in-market testing is simple: test a specific media treatment or campaign in a controlled, real-world market environment. For instance, you might consider launching a new TV spot but want to assess its potential impact before fully committing. You would choose two markets that are similar in key ways (e.g., demographics, category establishment), then expose one market to the treatment (TV spot) while keeping the other market as a “Control” (no TV spot). After running the test for a specified period, you compare the sales change in the Test Market versus the Control Market to estimate the incremental sales impact driven by the TV campaign.

Why is In-Market Testing underleveraged?

One of the main reasons In-Market Testing is underutilized is the opportunity cost. By holding back investment from a market or campaign, you risk missing out on potential sales in the short term. In addition, the time it takes to see clear results can make it less attractive when quick insights are needed. Another common misconception is that in-market tests can’t handle complex variables or large numbers of treatments, but in reality, they can be designed to accommodate a variety of factors.

Take for example an in-market test our Data Science team recently conducted with a fitness industry client. Using a number of test and control markets, the team was able to reliably measure a variety of media channels and derive recommended changes to the brand’s marco level media strategy. From there, the team is now conducting additional testing to optimize the mix within the most impactful channels. A benefit of this approach was that confident, statistically significant results were able to be presented in a way that even a non-technical audience was able to understand quickly, generating firm alignment on the actions to be taken.

Media Mix Modeling (MMM)

Finally, we come to what many consider the gold standard of commercial metric measurement: Media Mix Modeling (MMM). Initially developed in the mid-20th century, MMM has been a valuable tool for understanding the relationship between media spend and sales performance. While its popularity waned with the rise of Multi-Touch Attribution (MTA), the resurgence of MMM in recent years reflects a broader shift in the industry, driven by growing concerns over the limitations of MTA and increased data privacy issues.

What is Media Mix Modeling?

At its core, MMM is a statistical model that uses advanced techniques (typically time series regression) to quantify the relationship between media spend across various channels and total sales. The goal is to determine the optimal media mix by understanding how different channels contribute to overall sales, factoring in other influences such as seasonality, promotions, and economic conditions.

The key to MMM is having granular, high-quality data. You generally need data at the daily or weekly level, broken down by market, campaign and specific media channels. Additionally, control variables like external factors (weather, economic conditions, etc.) need to be incorporated into the model to isolate the true effect of media spend.

Why is MMM worth the investment?

Despite its complexity and potential cost, MMM offers powerful advantages. It can provide clear insights into the ROI of different marketing channels, and it allows for simulations that can help predict future outcomes based on different media spend scenarios.

When a client was recently faced with deciding how to allocate spend across nine different platforms, they needed a way to simultaneously compare each platforms’ spend. Enter Media Mix Modeling where we were able to quantify the MROI of each channel at different levels of spend using response curves from the model, which allowed us to optimize their mix by shifting from low-MROI channels into High-MROI channels. The result: we saw two quarters of increased overall ROI in media effectiveness after the budget shifts.

Commercial Metrics are essential for understanding the true return on your media investments and shaping your long-term media strategy. Whether you’re using Incrementality Testing for quick, exploratory insights; In-Market Testing for more robust, real-world results; or Media Mix Modeling for deep, data-driven evidence, each of these methods provides unique benefits and can help you optimize your media spend for maximum impact.

Key Takeaways: Measuring Success in Your Marketing Campaigns

- A strong measurement plan is essential – Tracking performance isn’t just about collecting data; it’s about using insights to optimize campaigns and prove marketing impact.

- Align measurement with business objectives – Every metric tracked should tie back to broader marketing and business goals, ensuring that insights lead to meaningful action.

- Collaboration across stakeholders is a must – Effective campaign measurement requires the combined efforts of analysts, media buyers, clients and other stakeholders, as well as data access and transparency.

- Marketing performance metrics provide real-time feedback – Metrics like impressions, click-through rates and conversions help marketers adjust campaigns on the fly for better results.

- Consumer response metrics assess brand impact – Surveys and research methods like brand lift studies and market effectiveness surveys reveal how your messaging resonates with audiences.

- Commercial metrics measure business impact – Methods such as incrementality testing, in-market testing and media mix modeling help determine how marketing contributes to revenue and ROI.

- Flexibility and continuous optimization are key – Effective measurement isn’t a one-time task; it requires ongoing tracking, adjustments and refinement to maximize marketing success.

By integrating performance, consumer and commercial metrics into a comprehensive measurement plan, marketers gain the insights needed to optimize strategies, demonstrate value and, ultimately drive measurable business impact. Effective measurement ensures that marketing efforts not only align with business goals but also contribute to tangible outcomes and long-term success.

This is not an advertisement, and solely reflects the views and opinions of the author. This website and its commentaries are not designed to provide legal or other advice and you should not take, or refrain from taking, action based on its content. Additionally, unless otherwise stated, neither 9Rooftops nor the author is involved in, or responsible for, the marketing or promotional efforts of the individuals or entities discussed.